How Fintech Software Development Can Empower Your Company

Discover Enhanced Power of Financial Technology

Harness the power of fintech software for your startup or new banking solutions.

See how leading fintech companies and financial institutions extend financial services to the unbanked or newly emerging markets with a proven and purpose-built data sciences platform. Rapid innovation awaits!

4 Ways We are Empowering Fintech:

Fintech Software and Workflow Augmentation

Exploit AI to serve unbanked users through new digital channels. Transform digital strategy and optimize IT costs through intelligent workflow augmentation.

Integrate more transactional data by parsing text files and linking info using external databases and lexicons. You do not need many tools to move data through your processes.

Built-in validation workflows ensure accuracy of data by flagging any data that does not meet your defined accuracy threshold.

In addition, Grooper’s scientific advances provide reliable product innovations that deliver measurable business value.

Document classification workflows are important for understanding data in forms and common document types.

Take a look at how easy it is with Grooper in the video below:

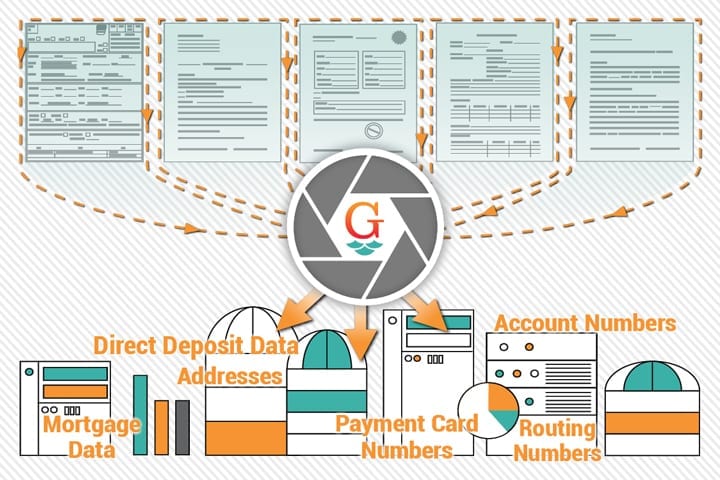

Financial Data Extraction Software and Deep Data Integration

Speed up transformation by using unstructured data from many external sources. Use fintech software as a catalyst to differentiate your brand through increased benefits, agility, and better customer service.

Transform business insight and data analytics through built-in:

Built-in integrations with on-premise and cloud document repositories mean quicker access to more source data.

And when you are ready to put accurate data to the test in a neural network or other intelligence engine, you will have confidence in the accuracy of your data.

Fintech Software Modern Architecture

Meet all growing and changing customer demand head-on with fintech that supports rapid innovation.

To do this, Grooper’s modern software architecture easily scales to process billions of data exports in a single day. Harness modern and powerful data science tools in a single purpose-built platform. With scalable parallel processing, the only limit is the amount of compute you have available.

With built-in AI tools, you have access to a modern tech stack. But we know every project is unique. Need a tool not included out of the box? Built-in API connectivity enables you to connect to other cognitive services in banking automation software.

FinTech Rapid Development

Respond to market changes faster by focusing more resources on product delivery. Developing new data models within Grooper is a repeatable and streamlined process.

While it is not open source, Grooper provides connections to a wide set of cloud-based AI tools from vendors like AWS, Google, and Azure.

Also discover and extract unstructured data from new sources. Then use this data to feed deep learning models the accurate data you need to automate decision making.

Grooper’s low code / no code design studio removes the barriers from taking a new idea to market. Built-in machine learning is combined with visual validation to show you how the model is working for real-time data testing. This is fintech software at it finest!

Financial Sector Testimonials

Featured Case Studies

Thousands of companies have chosen BIS to help solve problems with unique data solutions. Here are some of their stories:

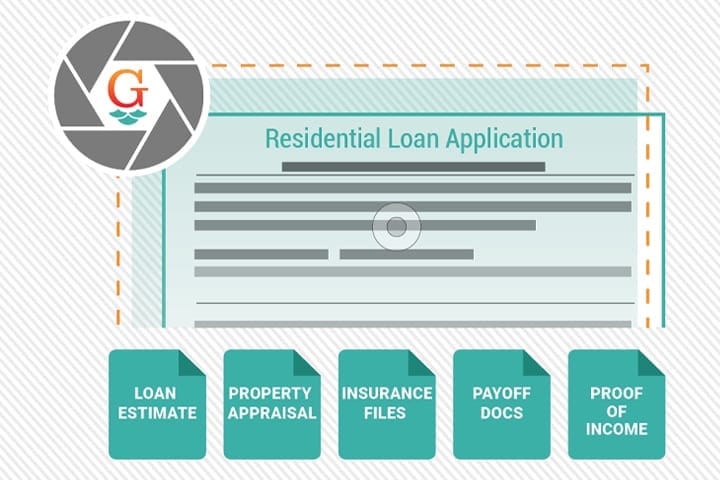

Automation Cutting Mortgage Processing Time in Half

A large nation wide credit union uses Grooper to streamline automated mortgage processing for their customers.

Quick PCI Data Protection That Works Across Core Systems

Managing PCI data contained across financial services content management systems, email servers, and file systems is extremely easy with Grooper.

How to Reduce Document Processing Costs by One Third

According to S&P reports, operating costs at banks and credit unions are catching up to revenue. But one large national financial institution is using Grooper to improve document and data processes by 37.5 percent.